One of the frustrating mistakes many have committed is that we sometimes try to make a payment on mobile banking apps, but they end up going to top-up (recharge) phones. And surprisingly enough, it’s rather too common that people have ended up in this same situation. This usually happens when people are trying to make a payment via mobile banking apps to eSewa, Khalti, or other payment service providers’ platforms. We tend to seek eSewa, Khalto, Ntc, Ncell help for the solution, and well, is there any? We explore more here.

Payment mistakenly went to top up the balance. How does it happen?

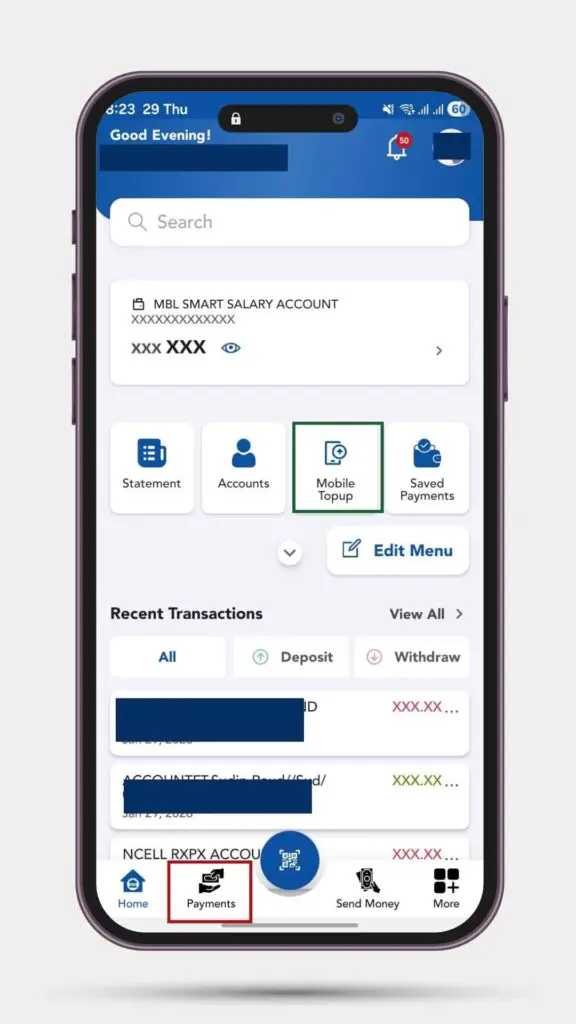

Suppose you need to pay after buying a product or receiving a service. You need to pay, but there’s no direct QR. So, you try to pay using your mobile banking app. Generally, you tap first on payment and then enter your digital wallet contact to initiate the payment. Mistakenly, if you directly tap on top-up (mobile top-up), enter the amount, and send it in a hurry, the mistake happens. Since it only takes a few taps in a few seconds, you only realize later that your payment didn’t get paid, instead went to the main balance (top-up) of the digital wallet account.

In gist, this happens when you do everything in haste. I do a lot of top-ups. I can’t remember the last time I used a recharge card to add balance to my SIM card.

Do telcos or digital wallets refund or return the balance when the amount went into a top-up?

Sadly, I contacted eSewa, Ncell, etc., and I was flatly told that there is no arrangement for a refund if the payment mistakenly went for a top-up. It’s frustrating that service providers in Nepal haven’t taken this situation into consideration for customer service. Digital payment tools are super convenient and common. But transaction mistakes such as these do happen. And there should and must be a solution for this- a refund or a return to correctly complete a transaction.

Anyway, here’s an indirect workaround for this, and I tell you from my personal experience.

What can you do when you happen to top up instead of paying the merchant?

Well, after you err to pay and instead top up your merchant, here’s a workaround.

- You had to make a payment, but you erred and did a top-up.

- That top-up goes into the main balance of the recipient (your merchant)

- Request the merchant to transfer the balance to your phone if it’s the same number, and if it’s not, request them to buy a gift pack and send it to your number

- The amount may not correspond, but if they are close enough, it’s fine. Mine was Rs 510, so buying a Rs 500 pack did it for me

- After you receive the gift pack, you proceed to make the payment, but carefully this time to ensure it is the intended payment

NOTE: Mobile balance transfer only works between Ntc to Ntc and Ncell to Ncell, and sending balance is not available for Ncell postpaid SIMs.

I happened to pay twice. What to do?

On a side note, when the payment is done twice inadvertently, of course, don’t fret. You need to contact your payment operator, such as Fonepay or the wallet. They will ensure that the amount held in between comes back to your account within 48 hours.

To illustrate, I recently happened to pay for my WorldLink subscription twice. The amount was debited from my bank account for both attempts. I contacted my bank, and they said that the payment had been cleared, so they couldn’t do much. However, WorldLink said the payment was completed just once. I was tense, but then I contacted Fonepa,y and they said that only one payment was done and the amount would be recredited into my bank account. It came back to me in 24 hours.

It’s an imperfect workaround!

Anyway, this workaround is usually applicable for a small amount up to Rs 1000 and around, depending on users’ needs and accountability to put up with the situation. After all, it’s up to you as the initiator to initiate the payment carefully. But in the absence of the direct refund or return service from service providers, this could be a sort of solution.

But the gist of this article is that every sane person, even the smartest and wise tend to give in to the desire to do things fast on a phone. This is why errors occur. Service providers such as digital wallets, operators such as Fonepay, and telcos all need to coordinate and bring us a solution for the payment to top up situation.