Mero Share is one of the essential tools for share investors in Nepal. It simplifies our share transactions online and offers many convenient features on the go. People use MeroShare to apply for IPO, Check Share Portfolio, Transfer Shares, Calculate WACC, and more. Find out what is Mero Share, how to take login, and all the features below.

Gone are the days when people had to fill up their details all on bulky documents to apply IPOs. Now the system has gone digital thanks to Mero Share. The app developed by CDS and Clearing Limited (CDSC) has become synonymous with stock investors in Nepal. If you want to buy stocks, check your transaction details, apply for IPO, Mero Share is your ultimate partner. It simplifies your share operations and saves you plenty of time.

What is Mero Share?

Mero Share is a platform created by CDSC (Central Depository System and CLearning) that has replaced traditional IPO operations in Nepal. Before people had to stay in queues to fill up a form to apply for IPO or visit their offices to see their details. With Mero Share, the beneficiary can easily get facilities on IPOs offering, their account transaction, history, etc. And that is all for a mere NRs. 50 a year.

Availability of Mero Share Platform

Mero Share is available on the website. However, if you want more convenience then you can download the mobile app from the Play Store. The app will enable you to enjoy its services on the go with internet access.

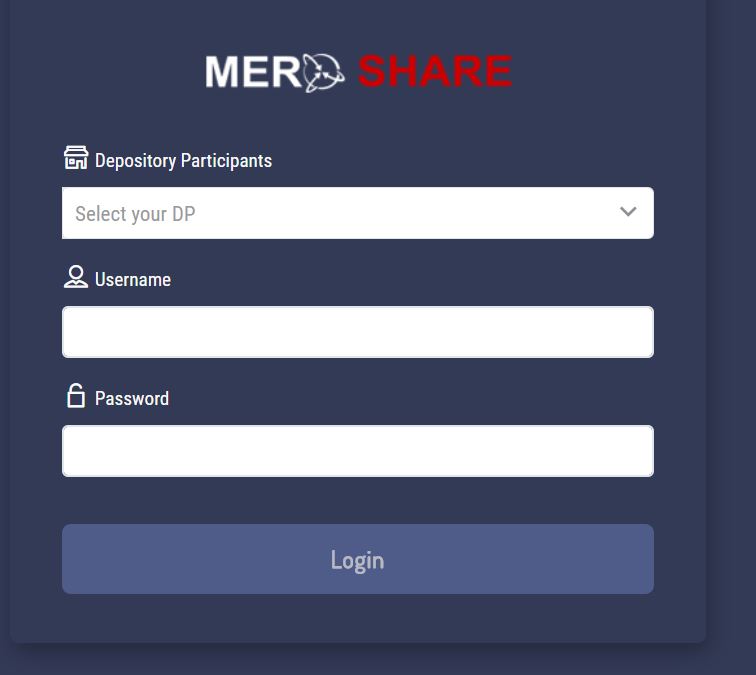

How To Log In to Mero Share?

Before you begin investments through Mero share there are certain things you need to do. Here is the breakdown of steps to guide you through the processes of Logging in to Mero Share.

- First and foremost you will need a Demat account. It’s a primary prerequisite for you to become an investor. To create a Demat account, you can go to your nearest bank where your account is created, or if the bank doesn’t provide this service go to a licensed broker or capital who will issue an authorized Demat account under your profile.

- Whichever institution issues you the Demat account it will be known as your DP (Depositary participants). It can usually be your bank but also can be brokers or merchant banks. The common practice is that you open your Demat account at the bank where you have your account created.

- You should consult the bank for the necessary documents required. Some banks charge you a moderate service fee while some provide the service without any cost.

- Usually, it takes two to three days for the Demat account to be created, depending on the pressure. Sometimes on the very day of application.

- Then you will take the CRN number which stands for C-ASBA Registration Number. For this visit the bank that has issued you your Demat account. Apply for CRN. In a few days’ time, you will receive your CRN number.

- After you get your CRN number, you can finally register for a Mero share account.

Recommended Read: Connect IPS: One Stop Solution for Digital Banking in Nepal

Login to the Mero Share account

- After creating a Demat account and getting a CRN number you will need a username and a password. Fill up a form for this with your email ID, phone number along with the DPID and Client ID. This service will require a fee of NRs. 50. If your details are valid, you will receive Mero Share login details in your email. Check the email, save the details then head over to the portal or use the app to log in.

- The duration of these processes depends on their demands. Normally it should not take more than a week to get it all done or even before. But if there is a high time for Demat and Mero Share it can take a while.

- As everything is set. Go to the Mero Share web portal of CDSC, select your depositary Participant (DP), and log in to Mero Share.

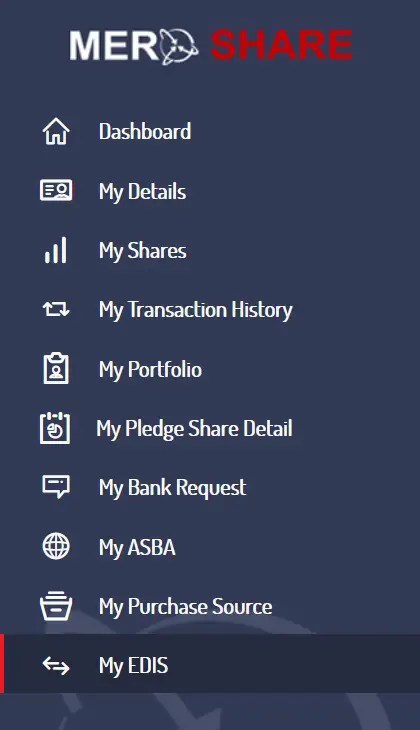

- Now you will be able to enjoy the online services of Mero Share. You will be able to check for the latest IPO releases, buy or sell stocks, etc. In case you have applied for IPO before, you will see its status.

How to Apply IPO Using Mero share?

As you have got your Demat account, CRN number, and Mero Share login, the next step is to explore IPOs (Initial Public Offerings) and apply for the ones that you find the potential for profit. See below to learn how you can apply for IPOs via Mero Share.

- Navigate to the My ASBA tab and then click on ‘Current issue’.

- Select the share names (IPO) to apply for and also the number of shares as per the limit stated.

- Choose the bank account (linked to your Demat account) and enter your CRN number.

- Enter the transaction code for the verification. The trasaction code is a 4 digit code that you have to set yourself for your account. It can be also changed by going to your profile and entering your password.

- Hit apply only when you confirm all the entered details.

How to Calculate WACC in MeroShare?

To confirm the Share transaction, you have to calculate the WACC for the share that you have sold. With WACC, they will find out the amount of Capital gain tax for the sold stock. Follow the following steps to calculate WACC (Weighted Average of Cost of Capital).

- Go to the My Purchase Source Tab in the MeroShare portal

- Enter the Scrip of the share that you have sold.

- Click Search and find the company, Select the Share list and proceed

- Check for the original price of the share that you had purchased.

- Confirm the rate list with the tick on declaration and update.

More about WACC:

WACC (Weighted Average Cost of Capital) is an investment tool, used by investors to decide whether to invest or not. By calculating WACC, you will be able to determine the minimum rate of return at which the company produces value for its investors. When it comes to calculating WACC, simply use the online WACC calculator that helps you to calculate the weighted average cost of capital by considering the simple WACC formula for the instant WACC calculations. The weighted average cost of capital can be used as a hurdle rate to assess the return on invested capital (ROIC) performance. WACC plays a key role in calculating economic value added (EVA). Typically, investors account to an online WACC calculator for their WACC calculations based on the total debt, tax rate, and rate of interest

How to Transfer Shares in Meroshare?

Once you have sold out some shares from TMS or broker, you need to transfer the share to the broker to complete the transaction. For this, you have to complete the WACC calculation first and then follow the following steps.

- Go to the My EDIS Tab in Meroshare login

- Click the Transfer Shares inside there.

- You will find the Share list that you need to transfer.

- Proceed to transfer the share that you have sold.

Now the share transaction needs to be done within T+2 days, that is the next day after selling.

Benefits of Mero Share

Here are the benefits of the Mero Share application for Stock/Share applications, transfer, and more.

- You can check the details of your account also called beneficiary account.

- Check the details relating to your stocks.

- Learn about the current value of your stocks as per the market climate.

- View the history of transactions on your account.

- Apply for IPOs and FPOs online.

- Contact DP and change the wrong details of your bank accounts if required.

- Buy, sell or transfer shares using the My Edis tab.

- Check the status of the IPO that you have applied for.

Conclusion

According to the recent news that broke out, there are more than 2 million Demat accounts and there is a genuine interest among youths and matured to try out their luck as investors. With the increase in Demat accounts, there is a straight increase in Mero Share accounts two as they both work in tandem.

Mero Share has superimposed upon the traditional book-keeping practices concerned with IPOs and shares. Today the investors can simply go to the web portal or use the Mero Share app to avail of the gamut of features and services. It has simplified investment operations in Nepal and increased online efficiency too.

Check out: Nagarik App Features and How to Use for Government services online.

Have you used Mero Share to run your shares operations? Comment your experiences below.