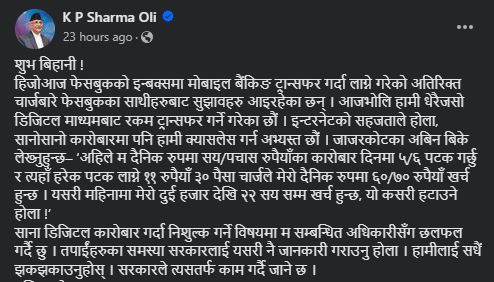

Prime Minister KP Sharma Oli has joined in on the fund transfer fare that has been brutally criticized ever since its implementation. The PM, sharing a post on Facebook on Saturday, September 14 shared that he is discussing the possibility of making small mobile transactions (involving low amount transactions) completely free.

In July, service providers increased tariffs on fund transfers reaching a maximum of Rs 11.30 which applies to even transactions of Rs 10. It’s unscientific for those make process low amount transactions.

Earlier, PM’s political advisor Bishnu Rimal also remarked that the mobile banking app’s charges were expensive.

Prime Minister KP Oli has mentioned that he is discussing with the relevant authorities about making it free of charge as even small businesses are becoming digital due to the convenience of the internet.

Check out: Transaction Limit in Mobile Banking, Internet Banking, and Wallets

PM Oli in discussion to make small transactions free of charges

Because of the internet, we are habituated to going cashless even for small transactions. Quoting Abin BK from Jajarkot, Oli continued,” Now I process daily transactions of Rs 100/Fifty 5/6 times a day, and the 11/30 paisa charge every time costs me Rs 60/70. In this way, I spend from 2000 to 2200 per month, how can I remove this!’

The PM said that he is in talks with concerned officials to make these low-amount transactions free of any service charges.

Although the government continues to promote electronic payment such as the 10% VAT refund at hotels, restaurants, bars, etc., the introduction of VAT on digital transactions through the Finance Act of FY 2081/82 has made mobile banking charges more expensive.

Are you hurt by the Rs 11.30 transaction charge?

Or the question should be how much are you hurt by the newly-implemented Rs 11.30 charge in a transaction? As said above, for high-volume transactions, the service fee can be justifiable. However, for regular non-business users who only transfer funds or pay at malls, restaurants, etc., the fare turns out to be illogical.

If you process a transaction of Rs 10 or Rs 50, then having to pay Rs 11.30 for the service makes no sense. Duely, the service charge has been questioned and criticized and the PM having his attention drawn could help with arrangements to reverse this. It’s hard to believe that the government promotes electronic payment so religiously but at the same time, allows such exorbitant fares to come into effect.

Let’s hope that the PM’s concerns materialize into some tangible action to soothe this issue.