Now the old-school way of trading shares with a share certificate at the broker’s office is gone. Investors using share certificates to trade has been replaced with digital trading using demat account. So, you need to dematerialize your physical shares (share certificates) to engage in the share market with more flexibility and convenience. In this post, we provide you with the process to dematerialize your physical shares.

Table of Contents

About Dematerilzation in Nepal (Abhautikikaran)

Up until a few years ago, when you had shares of a company, you would be issued a share certificate which is also called physical shares. You would have to carry this to the broker’s and trade shares. Now it is mandatory to dematerialize your share for electronic transaction of the stock,

Dematerialization (Abhautikikaran) means transforming your physical shares or share certificates into an electronic form, aka digitalization of physical share certificate.

In Nepal, Demat accounts have been used for the share market since 2072 Magh 01. Also keep a note that Demat us mandatory and default way of share transactions these days.

First, to convert your physical shares, you need a Demat account. In case, you don’t have a Demat account, visit any Capital, Bank, or broker’s office to open your Demat account. Now you can also create demat account online in some of the Capital. There, you fill out a form that allows you to dematerialize your physical shares (share certificate).

Why do you need to dematerialize your physical shares? (Share certificate?)

Now you are required to dematerialize your share certificate to engage in various share-market-related activities. First, it helps you buy and sell shares on the go on your smartphones, apply for the right shares, get bonus shares, receive dividends, etc.

Simply put, Demat helps you with digital share-market operations otherwise, you would have had to take physical share certificates to the brokers to trade shares, etc.

Most importantly perhaps, dematerialization allows you to trade shares in the secondary market.

After you demat, you get all your stocks’ data in an electronic firm which makes the entire process faster and time efficient. Below, we break down the advantages of having a Demat account.

Check out: Brokers Can Use Their Own TMS for Trading Shares

Advantages of converting physical shares into a Demat account

After you dematerialize your physical shares, you earn easy access to all the stock market activities, you first need to convert your physical shares into a Demat. Having a Demat account enables investors to access their share certificate in an electronic form as well as benefits due to its electronic nature. Here are the key advantages of converting physical shares to a Demat:

- Convenience: Demat means your physical share or share certificate is dematerialized. It means, your share details are now stored in an electronic form and you can access them on smartphones and computers. So, having a Demat means, you need not worry about your share certificate or shares being lost or stolen. Your DP securely stores them in servers.

- Accessibility: As stock details are stored online, accessing them becomes easier. You can access your shares on smartphones and PCs using the internet, anywhere, anytime.

- Safety: Once you turn your physical share certificate into a Demat, your DP takes care of it. It’s kept online and secured via layers of advanced security protocols. That means you won’t have to bother with your physical shares being wet, damaged, forgotten, misplaced, etc.

- Flexibility: As you leave behind your physical shares, a Demat account lets you sell any number of shares in the secondary market. You also don’t need to knock on the broker’s office to trade shares. The flexibility lets you increase your share market activities at your own convenience.

Check out: How to check IPO allotment results in Nepal?

Steps to dematerialize your physical shares?

The process is easy but might take some time to get it done. Here are the steps to dematerialize your share certificate:

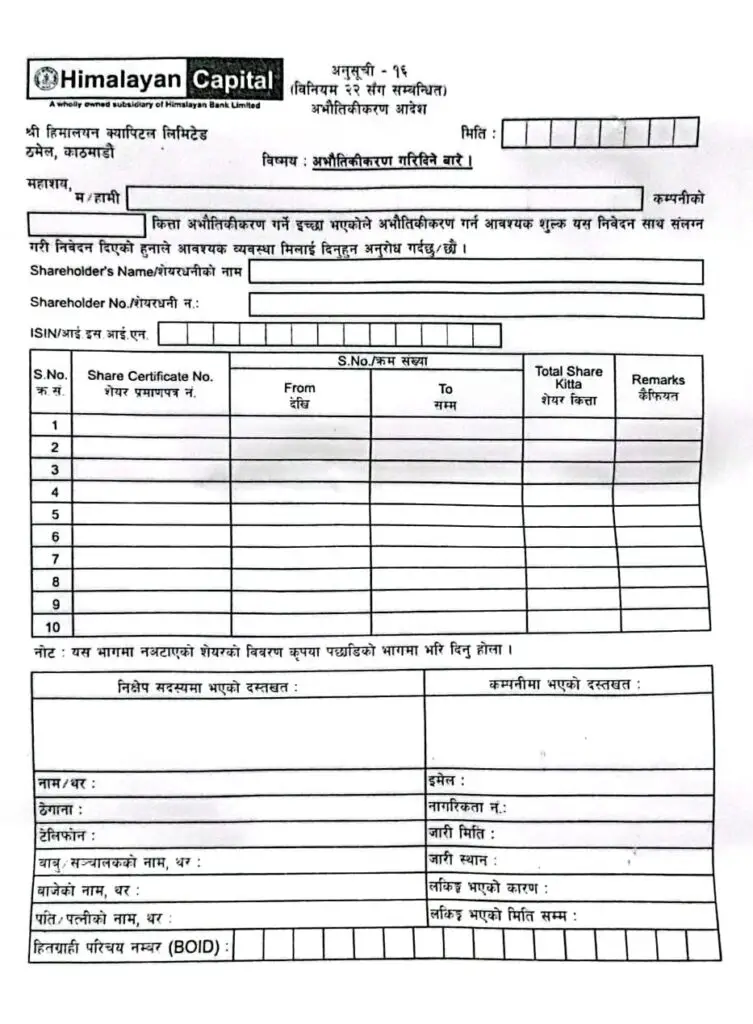

- Visit your Capital also called Depository Participant (DP) where you have opened your Demat account such as Nabil Capital, MBL Capital, etc.

- Fill out a form including your personal details (according to your citizenship), share unit details, and number of shares, and attach a copy of your share certificate.

- DP then sends your documents to CDSC for verification and also requests for its verification.

- CDSC then forwards the documents to share registrar for further procedure.

- Share registrar verifies the documents and then confirms the Dematerialization request.

- CDSC then confirms to DP that your shares have been dematerialized

- After this, DP provides you a statement of Dematerialization where you can find all the status of your shares in an electronic form.

- It takes up to 3 days in regular times or up to 5 days during the Bullish period to get your share dematerialized. It may as well take over 5 days too for technical reasons.

- When it’s all done, you can see your shares on the Mero Share (if you have it).

Well, we hope this post has been informative to you. For more queries on it, feel free to drop them in the comment section below.