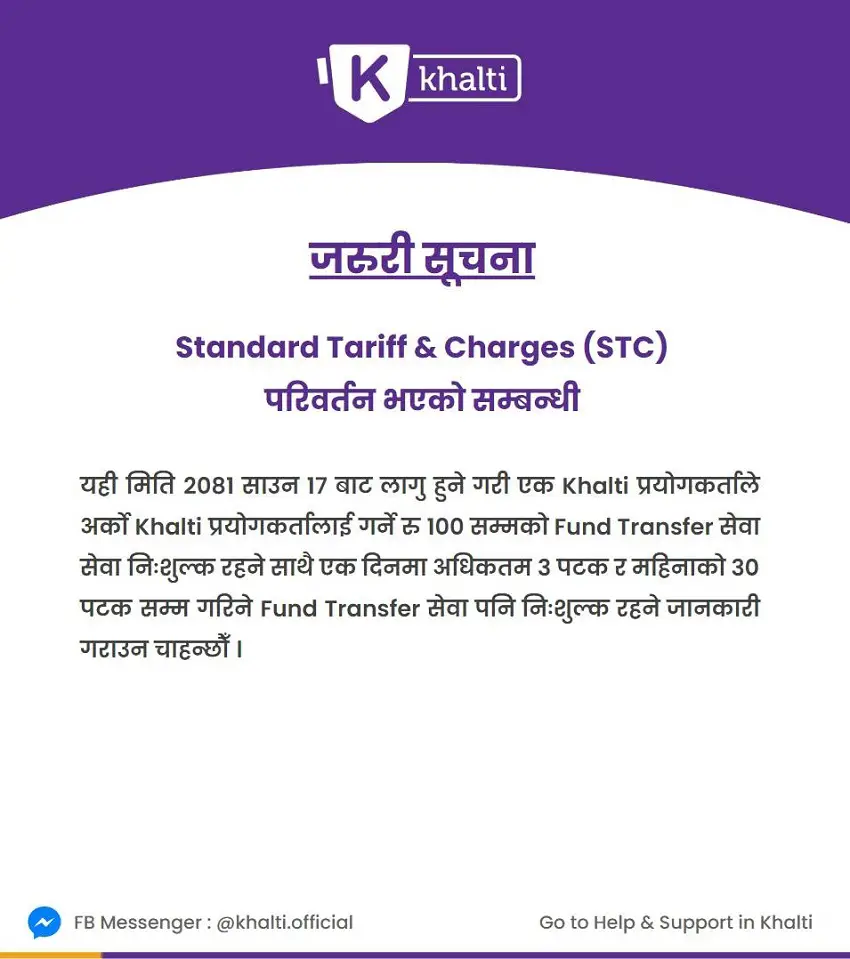

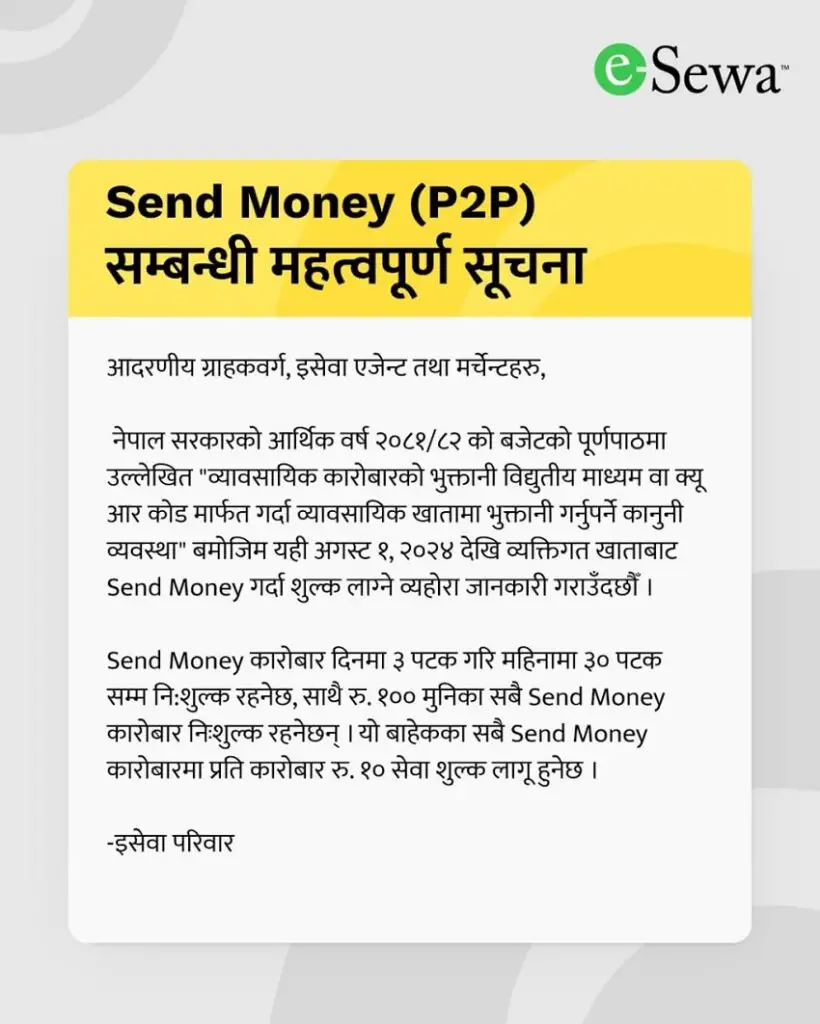

ESewa and Khalti have both announced charges on daily money transfers between their wallet accounts. Announcing the decision, the leading digital wallets said that from Shrawan 17, 2081 (August 01, 2024), it costs Rs 10 per transaction for transactions over Rs 100.

So far, money transfers have been free of cost on both eSewa and Khalti, however, the company has introduced fees on transactions. With the new tariff, eSewa-eSewa and Khalti-Khalti money transfers now cost Rs 10 per every transaction of over Rs 100 after three transactions.

That is to say, it’s free to Send Money for three times of all amount but for the amount over Rs 100, the free limit is three per day. Likewise, both wallets say that there won’t be any fee for transactions of over Rs 100 for 30 times a month. Also, transactions of below Rs 100 are free with no limit whatsoever.

| Digital wallet transfer limit per day | eSewa | Khalti |

| Below Rs 100 | Free | Free |

| Over Rs 100 | Rs 10 (after three transactions) | Rs 10 (after three transactions) |

Khalti says that the move to introduce Standard Tariffs and Charges (STC) promotes the Nepal Government’s provision mentioned in FY 2081/82 to deposit amounts transacted electronically or via QR codes in personal accounts (person-to-person) that are done for commercial purposes.

Likewise, eSewa mentioned the same government’s provision for implementing fees on money transfers. According to the company, it has enforced service fees on Business QR from Shrawan 17, 2081 (August 01, 2024).

The digital wallet now allows free money transfers up to three times a day and thirty times a month. Likewise, all transactions below Rs 100 will bear no costs. However, any money transfer (Send Money) over Rs 100 after three transactions will cost Rs 10 per session of transactions.

Khalti, eSewa daily transaction limit in 2024

To reiterate, both Khalti and eSewa have now set daily transaction limits on free money transfers up to three times a day for transactions over Rs 100. After each transaction of an amount over Rs 100, users will be charged Rs 10 per transaction.

The burden on digital payment users?

Both eSewa and Khalti are setting limits on free money transfers per day, which means customers will bear more financial burdens for their transactions. Already, Fonepay and Nepal Clearing House Limited have added 13% VAT on their payment services.

Now, with both countries leading digital wallets setting extra fees on transactions could adversely hurt the users who rely on electronic modes for payment. This is probably not likable news for over 12 million users of eSewa and Khalti.

But other top mobile payment vendors such as IME Pay, Hamro Pay, etc. have not yet announced their revision into the money transfer fees or their introduction.